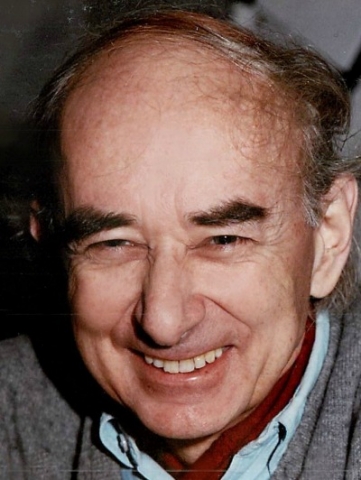

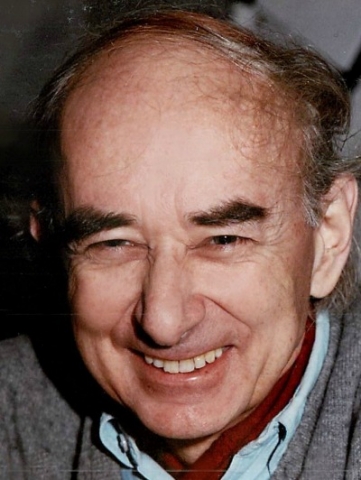

Lucien Foldes

Emeritus Professor of Economics. Member of Financial Markets Group and Systemic Risk Centre, LSE.

Emeritus Professor of Economics. Member of Financial Markets Group and Systemic Risk Centre, LSE.

This Paper continues the study of the Optimal Consumption Function in a Brownian Model of Accumulation, see Part A [2001] and Part B [2014]; a...

In Part A of the present study, subtitled 'The Consumption Function as Solution of a Boundary Value Problem' Discussion Paper No. TE/96/297, STICERD...

The present work deals with optimal planning in continuous time, infinite horizon, stochastic neo-classical one-sector models of economic growth (or...

Concepts of asset valuation based on the martingale properties of shadow (or marginal utility) prices in continuous-time, infinite-horizon stochastic...

The model considered here is essentially that formulated in the author's previous paper Conditions for Optimality in the Infinite-Horizon Portfolio...

This paper is a sequel to [2], where a model of optimal accumulation of capital and portfolio choice over an infinite horizon in continuous time was...

A model of optimal accumulation of capital and portfolio choice over an infinite horizon in continuous time is considered in which the vector process...

A model of optimal accumulation of capital and portfolio choice over an infinite horizon in continuous time is formulated in which the vector process...